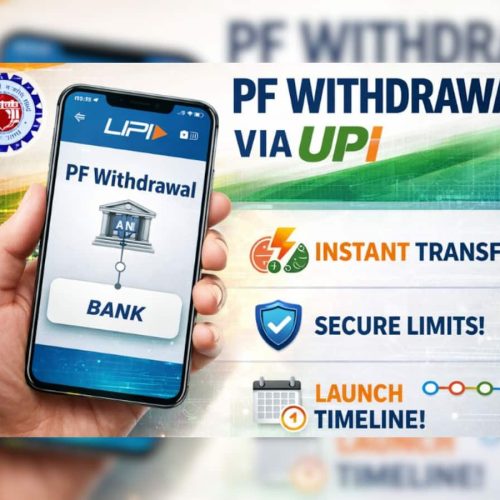

EPFO New App Features: The Employees’ Provident Fund Organisation (EPFO) is developing a new mobile application that will allow its 8 crore members to withdraw their EPF balance directly into their bank accounts using the Unified Payments Interface (UPI). As per reports, a certain portion of the EPF balance will be frozen, while a large share will be available for withdrawal through the UPI gateway, along with access to other services such as passbook balance details.

The move is part of EPFO’s EPFO 3.0 upgrade and aims to make PF access as simple as using a banking app, with an instant, paperless, and fully digital withdrawal process. Currently, salaried employees use either the Universal Account Number (UAN) portal or the UMANG app to access their EPF accounts and related services.

EPFO New App: What’s New

The Ministry of Labour and Employment is currently conducting trial runs using 100 dummy accounts to identify and resolve technical issues ahead of the public rollout in April 2026. The new auto-settlement mode processes claims electronically within three days, without any manual intervention. (Also Read: Airtel’s Evergreen Recharge Plans 2026: Unlimited Calls, 5G data, 100 SMS per Day, and 20+ OTT apps; Check prices and other benefits)

Under this system, the claim limit has been raised from Rs 1 lakh to Rs 5 lakh. The initiative aims to simplify the withdrawal process and reduce the workload of EPFO, which handles over 5 crore claims annually, mostly related to EPF withdrawals. Officials said the government wants to bring EPFO services on par with banks. Meanwhile, while the new EPFO app will serve as the primary platform for UPI-based withdrawals, existing services such as the EPFO Unified Member Portal and the UMANG app will continue to operate for other functions.

EPFO New App: Features

The new facility allows EPFO members to transfer eligible funds to their linked bank accounts almost instantly using their UPI PIN, bypassing the traditional claim process that can take several days. Through the new app, subscribers will be able to view the eligible EPF balance available for transfer to their seeded bank accounts directly within the mobile application.

This enables members to access their EPF money within three days for purposes such as illness, education, marriage, and housing. Initial discussions suggest a withdrawal limit of Rs 25,000 per transaction for UPI-based transfers. (Also Read: boAt Chrome Iris smartwatch launched in India with Bluetooth calling and health feature; Check specs and price)

The app will clearly show the eligible balance while keeping 25% of the total balance locked for retirement security. This service will be available through a dedicated EPFO app, integrated with the BHIM app and other UPI platforms.