While artificial intelligence models were once limited to isolated use cases in Indian retail, they are becoming indispensable today

As for Indian investors, AI use cases have become a key evaluation point when making investment decisions

That said, real-time, high-quality data is still the moat. This also explains the renewed focus on offline retail—not for foot traffic alone, but for data capture

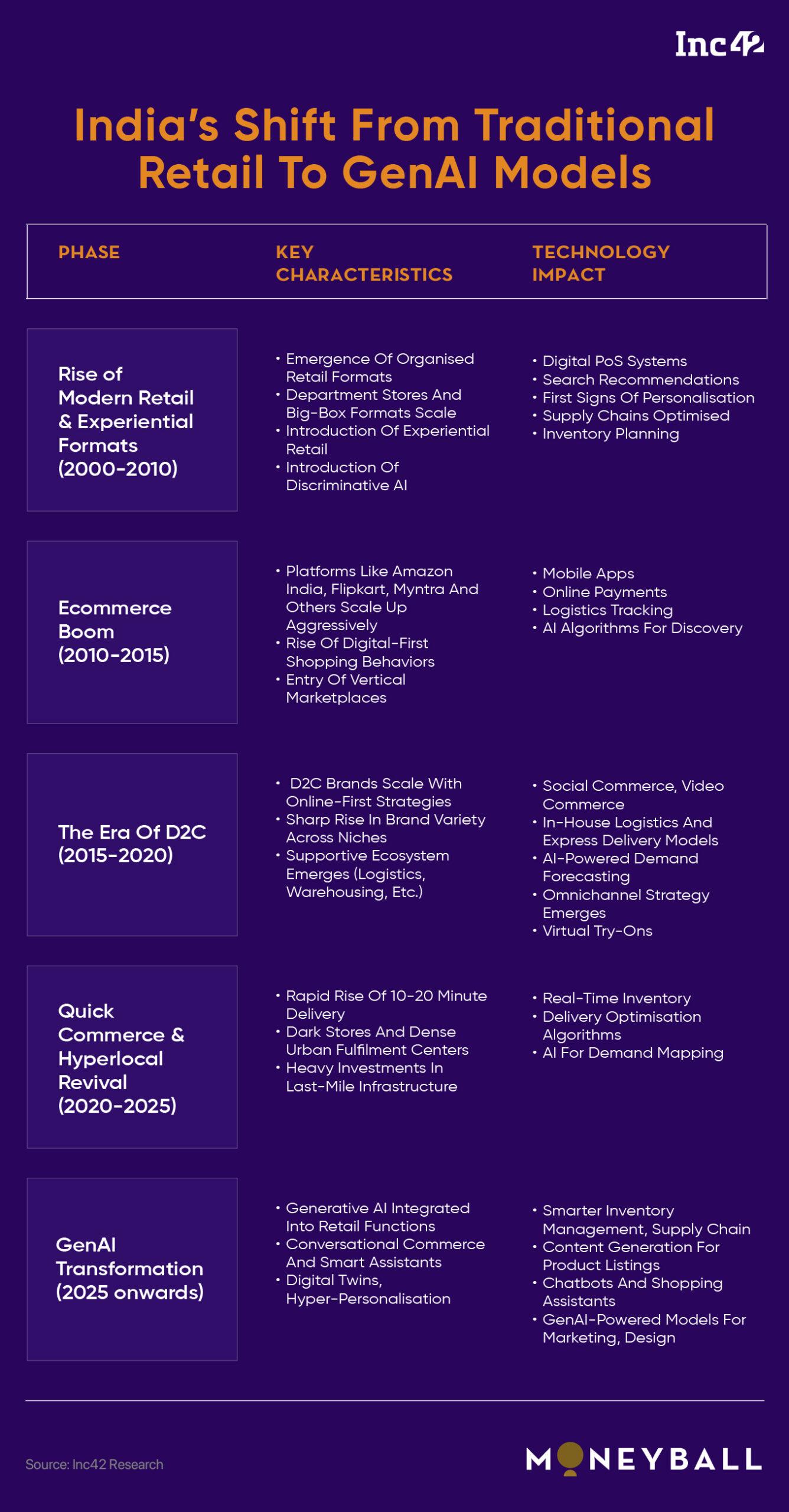

In 2013, Indian organised retail was defined by large-format stores and modern trade chains. All that changed with ecommerce platforms like Amazon India, Flipkart, Myntra, Snapdeal and others venturing into Tier II and III cities. But the rise of ecommerce only spurred physical retail after a period of disruption, led by Future Group, Reliance Retail, DMart, Tata-owned Trent and several other supermarkets.

Between 2017 and 2022, the D2C segment and new-age brands brought in a new era of online shopping and digital-first models, leveraging modern marketing, UPI and digital payments, analytics and logistics prowess. More than a decade after the ecommerce revolution began, India’s retail giants and marketplaces are now dealing with the rise of AI, particularly GenAI in 2022 till now.

If anything, these maturing digital journeys of consumers have opened up a clear path for generative AI, advanced analytics and predictions, and AI-native workflows.

AI In Retail: From Peripheral To Central

While artificial intelligence and GenAI models were once limited to isolated use cases in Indian retail, they are becoming indispensable today. From inventory planning to product discovery, AI is becoming core to ecommerce and marketplace needs in many ways.

Until 2022, the Indian ecommerce and retail players largely leveraged AI for discriminative models — using structured data for product recommendations, personalised offers, and demand forecasting.

“This was a phase where AI contributed to functional improvements across operations,” says Gowri Shankar Nagarajan, a partner at early stage investment firm Antler, adding that these models helped optimise logistics and improve CX, but were mostly deployed in the background.

Post-2021, the shift toward GenAI in retail opened new possibilities. These models handle unstructured data i.e text, audio, video to enable voice commerce, automated content generation, and chatbot-led customer support, improved logistics tracking and more. .

Product discovery also changed. Manual tagging has been replaced with AI-driven annotation of products and images at scale, which has changed how consumers find the products across devices.

“As we look ahead, GenAI will influence not only backend processes but also how retail brands interact with customers across touchpoints,” adds Nagarajan.

Are Ecommerce Investors Watching AI?

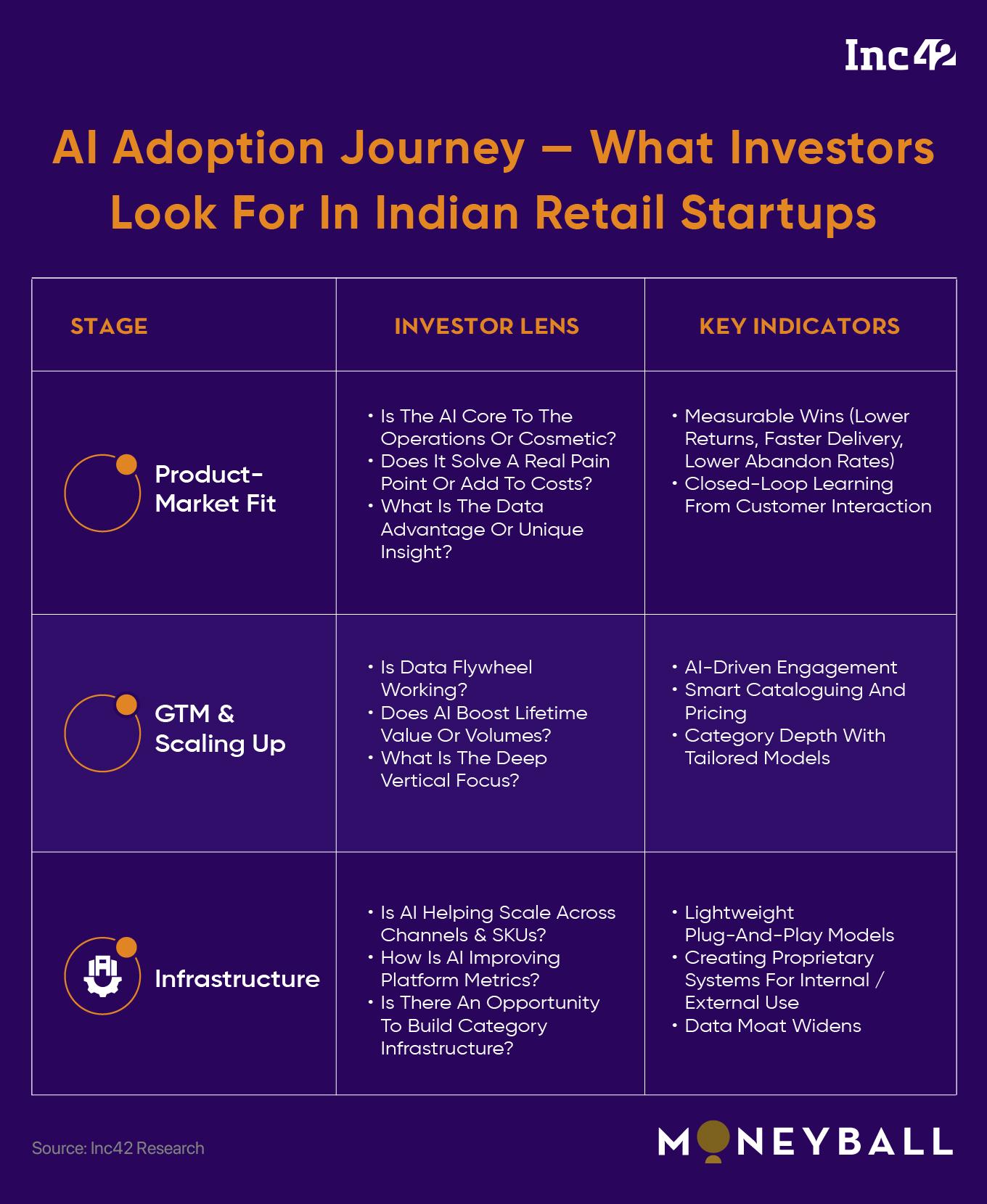

As for Indian investors, AI use cases have become a key evaluation point when making investment decisions. Digital-first D2C brands are adopting AI to enhance lifetime value, streamline operations, and make data-driven decisions.

But there’s a lot of noise around GenAI. In retail, the value lies in using tech to solve legacy problems, according to the investors such as Rahul Agarwalla of SenseAI.

Rising customer acquisition cost, pressure on margins, and fragmented supply chains are compelling brands to turn to AI for efficiency and improved logistics.

Logistics costs in particular are critical to improving the unit economics of brands, and many third-party logistics players and logistics SaaS players are leveraging machine learning models and neural networks to reduce costs and build on top of granular geolocation data. This has allowed brands to cater to the right consumers at the right time.

According to Adarsh Menon, partner at Fireside Ventures, AI-led supply chain management is still early in India, but has strong upside. Most 3PL providers are yet to fully integrate these capabilities, so there is a gap in the market. However, integrated AI logistics could materially reduce working capital cycles and stockouts.

“The modularity of the current AI stack means a founder can start lean and then use attribution models or dynamic pricing tools out of the box,” added Nagarajan.

That said, real-time, high-quality data is still the moat. This also explains the renewed focus on offline retail—not for foot traffic alone, but for data capture. In this context, omnichannel is more about data collection than actual presence, and AI can come into play here too.

Investors also agree that the next key driver in AI retail innovation is consumer-level personalisation. This goes beyond recommendations and includes individualised journeys and messaging, aimed at improving conversion rates.

But how has AI changed how deals are made and due diligence for ecommerce?

What Investors Look For In Retail GenAI

Like in most other segments, AI evaluation is now part of the due diligence checklist across funding stages for investors in retail as well. Having a clear AI strategy is becoming mandatory.

At the seed stage, the expectation is that founders know where AI will be applied over time. For example, SKU optimisation becomes critical once inventory scales. Without AI, those decisions tend to rely on guesswork or legacy systems.

Founders aren’t expected to build AI tools in-house. What investors expect is an embedded approach—especially in digital or omnichannel models.

“What we want to see early on is whether the AI logic improves defensibility,” says Nagarajan of Antler. “Is it using proprietary data? Does it improve outcomes over time?”

Measurable changes in unit economics and conversion have become essential markers for investors. At the growth and late stage, expectations shift towards infrastructure, smarter algorithmic plays to grow engagement and loyalty and AI for distribution intelligence.

As a business adds complexity—more SKUs, more locations, more channels—AI-driven workflows create operating leverage, and category and sales managers must articulate a plan for implementing AI at scale with marketing and technology teams, he added.

Adoption, Risk And Execution: Investor Priorities In AI Retail

However, the reality is that most Indian startups are not building proprietary AI; they are integrating external APIs and platforms.

Investors view this pragmatically for the time being, provided it results in measurable impact: lower returns, better targeting, improved workflows. The name of the game is efficiency and productivity at the moment.

For now, investors are backing startups that embed AI with intent—improving fundamentals, building defensibility, and showing how these new models are increasing growth and adding to value.

A common challenge in implementing proprietary models is identifying the right use cases and data for training. Retail-first businesses may struggle with this, given the disparity of data here. And adopting AI tools off the shelf is the easiest answer, but represents a cost risk in the long run.

Talent to cater to the retail sector’s AI needs remains another hurdle, as most companies are in a highly competitive market when it comes to hiring for AI talent. So ecommerce players and omnichannel retailers have to do a cost-benefit analysis of the build vs buy debate.

“For traditional retail founders, knowing what to build and when is half the battle. We want to see clarity on what AI improves—and how,” added Menon, emphasising the difference in AI-enhanced ecommerce models and AI-native approaches.

The tipping point will come when larger retailers demonstrate consistent gains through GenAI and LLMs. That adoption curve will then filter down to smaller players. Even though ecommerce startups and digital-native brands began the AI revolution, the big transition has to come from larger enterprises in this space.

[ad_2]

Leave a Reply